译者按:本文译自欧洲企业组织《兴业欧洲》 (Business Europe)的英文建议书,该英文建议书源自https://www.businesseurope.eu/mission-and-priorities。《关于加强欧盟在制裁领域经济外交的建议》是欧洲企业界的呼声,对于欧盟的《阻断法规》的走向将发挥重大影响。该文对于中国政府以及中国实业界具有重大的参考价值。如有任何疑问,可以与译者联系。

Business Europe speak for all-sized enterprises in 35 European countrieswhose national business federations are our direct members. The organisation isheadquartered in Brussels.

《兴业欧洲》代表欧洲大陆的企业,为35个欧洲国家的所有企业发声,其中每一国家的商业联合会均是《兴业欧洲》的直接会员。该组织总部设于布鲁塞尔。

The views and positions in this paper are not supported by the Polish Confederation Lewiatan and the Lithuanian Confederationof Industrialists (LPK).

*本文中的观点和立场并未得到波兰联邦私人雇主协会和立陶宛工业家联合会(LPK)的支持。

KEY MESSAGES 主要信息

Business opposes the weaponisation of the sanctions policy and the use of such measures to pursue economic interests. Sanctions are designed specifically to enforce the respect of international law, to counter fundamental threats to peace and stability and the protection of human rights and must be limited to these core purposes.

企业界反对以制裁政策为武器图谋经济利益。设立制裁制度是为了强化对国际法的尊重,反击对和平与稳定的根本威胁以及保护人权等,制裁必须限于这些核心目的。

We welcome the political attention to this matter and support a more assertive approach by the EU to protect its sovereignty in economic diplomacy. Unilateral measures that risk escalation with third countries should remain an option of last resort and multilateral approaches should be actively sought where possible. Especially with the USA as our traditional ally, the main aim must remain to achieve alignment on sanctions policies and implementation. A close cooperation regarding sanctions should also be established with the UK as part of the future relation.

我们欢迎对这一问题予以政治性关注,并支持欧盟采取更果敢的做法,维护经济外交之中的主权权益。单边措施存在与第三国的对抗升级的风险,是最后的手段;在可能的情况下,应积极寻求多边方案。特别是基于美国与我们的传统盟友关系,我们的主要目标仍在于达成制裁政策及其执行方面的共识。并在未来还应与英国在制裁方面建立密切的合作关系。

The aim must be to deter harmful action by third countries and, if necessary, to increase the costs for such harmful action. To do so, the toolbox needs to be better equipped with well-targeted, non-discriminatory, and well workable and implementable solutions. In the current absence of an effective mechanism, EU companies are caught between a rock and a hard place.

欧洲的目标乃是阻止第三国的有害行为,并在必要时增加这种有害行为应付出的成本。为此需要更好地配备针对性强、非歧视性以及切实可行的解决方案。目前因缺乏有效的机制,欧盟企业进退两难。

The EU, together with its allies, should take international leadership on this issue leveraging on its economic and political weight. The EU should insist on a multilateral strategy as this will increase the political strength of the argument.

欧盟及其盟友应该利用经济和政治影响力在这一议题上发挥国际上的主导作用。欧盟应该坚持多边战略,以增强论争的政治力量。

INTRODUCTION 导论

Recently, the independence of the EU foreign economic policy has been increasingly debated not the least due to the extraterritorial impact of third-party sanction regimes, namely those by the United States. Notably this was the case with the implementation of sanctions on Cuba through the Helms-Burton Act in May 2019; the reintroduction of sanctions on Iran after the withdrawal of the USA from the Joint Comprehensive Plan of Action (JCPOA) in May 2018; the enactment of the “Countering America’s Adversaries

through Sanctions ACT” (CAATSA), which resulted also in imposing sanctions against the aluminium company Rusal in April 2018, which created major bottlenecks for the EU aluminium market; as well as, most recently, the sanctions under the ”Protecting Europe’s Energy Security Clarification Act”, targeting Russia and impacting two big European energy projects. Notwithstanding the previously long-standing coordinated trans-Atlantic approach to sanctions and the efforts of the European institutions, these measures were imposed unilaterally and were not coordinated with the European Union. Also, they have a negative impact on European companies’ interests and undermine the EU’s capability to pursue its foreign economic policy interests independently.

最近,针对欧盟外交经济政策的独立性,争议越来越多,明显与第三方制裁制度(即美国制裁制度)的域外影响有关。其中值得注意的是,2019年5月通过《赫尔姆斯-伯顿法案》对古巴实施制裁;2018年5月退出《联合全面行动计划》(JCPOA)后重新对伊朗实施制裁;《以制裁反击美国敌手法案》(CAATSA)之颁布,2018年4月铝公司Rusal由此遭到制裁,这给欧盟铝市场造成了重大瓶颈性阻塞;还有最近基于《保护欧洲能源安全澄清法案》所实施的针对俄罗斯所进行的制裁,影响了两个大型欧洲能源项目。尽管以前就制裁在跨大西洋间协调一致,欧洲各机构也付出了努力,但这些措施均是单边制裁,没有与欧盟进行协商。此外,它们还对欧洲公司的利益产生了负面影响,削弱了欧盟独立追求外交经济政策利益的能力。

BusinessEurope welcomes the initiative of the European Commission to work on the broader issue of European economic and financial sovereignty, that should be based on the ongoing work on deepening the Economic and Monetary Union. Concerning sanctions, we welcome measures that aim to strengthen the EU’s assertiveness and resilience both regarding its own and third-country sanction regimes and to modernise the tools at hand, such as the Blocking Statute Regulation.

《兴业欧洲》欢迎欧盟委员会在持续深化经济和货币同盟的基础上,就欧洲经济和金融主权这一更广泛的议题着手工作的倡议。关于制裁,我们欢迎旨在加强欧盟在本国和第三国制裁制度方面的果敢和弹性的措施,并使现有方法(例如阻断法规)现代化。

BusinessEurope proposes measures in five kea areas with a view to delivering a well targeted and workable sanctions policy able to respond to today’s economic and business realities also for European companies. The paper also includes some proposals in the area of payments and the role of the euro, which should be integrated in the overall work on the Economic and Monetary Union.

《兴业欧洲》也为欧洲公司提出了五大领域的措施,以期实施一项目标明确、可行的制裁政策,以应对当今的经济和商业现状。此文件还针对支付领域和欧元的地位方面提出了一些建议,这些建议应纳入经济和货币同盟的总体工作。

RECOMMENDATIONS 建议

International outreach 国际拓展

Take a holistic approach on US extraterritoriality, not only on sanctions but also on other issues (anti-corruption, anti-money laundering, export controls, etc.) and ensure a united approach by member states. In principle, action at the European level should be privileged in order to maximise leverage in negotiations with third countries.

对美国治外法权采取全面的办法,不仅在制裁问题上,而且在其他问题(反腐败、反洗钱、出口管制等)上,并确保会员国采取统一的办法。原则上,欧洲一级的行动应享有优先性,以便在与第三国谈判中最大限度地发挥杠杆作用。

In order to act unitedly on this and other issues a move to qualified majority voting (QMV) in foreign policy matters should be prepared and envisaged for the future.

为了就这一问题和其他问题采取一致行动,我们应该准备并设想未来在外交政策问题上转向合格多数票表决(QMV)办法。

Include this issue also in the framework of European economic diplomacy and raise the issue of extraterritorial effects of sanctions at multilateral level in the relevant fora (G7, WTO) as well was bilaterally.

将这一问题也纳入欧洲经济外交框架,并在有关论坛(七国集团、世贸组织)以及双边会议上及多变层面上提出制裁的域外效力问题。

Agreement should be sought on an international level (e.g. G20, G7, IMF, GAFI, BIS) that goods and services which are systemically necessary for the functioning of our economies to conduct legitimate trade, in particular certain financial transactions or platforms and critical infrastructure, should in principle remain independent from political action (exceptions can be considered e.g. for sanctions by the UN Security Council).

应在国际一级(例如20国集团,七国集团,国际货币基金组织,全球金融机构,国际清算银行)寻求达成协议,以保证我们经济运行、进行合法贸易所必需的商品和服务,特别是某些金融交易或平台和关键基础设施,原则上独立于政治行动(可以考虑例外的措施,例如联合国安理会的制裁措施)。

Keep engaging with international allies to try and coordinate sanctions policies with a view to supporting common foreign policy goals but remain firm on EU businesses’ right to engage with or disengage from foreign partners while respecting all applicable European legislation. Towards third countries this right must be protected with the appropriate juridical tools under EU or member state jurisdictions.

与国际盟国保持接触,努力协调制裁政策,以支持共同的外交政策目标,但仍坚持欧盟商界与外国伙伴接触或者脱离的权利,同时尊重所有适用的欧洲立法。针对第三国,这项权利必须受到欧盟或成员国管辖下的适当司法工具的保护。

Attentively observe the measures other countries are taking in order to avoid dollardominated channels and consider whether certain elements of these approaches could inspire the EU’s own measures.

用心观察其他国家为避免美元主导而采取的措施,并考虑这些措施中的某些因素是否能够激励欧盟本身所能采取的措施。

Ensure workability of third-country sanctions with extraterritorial effect

确保具有域外效力的第三国制裁的可操作性

In cases where European operators are facing a catch-22 situation of conflicting laws impacting their operations in different countries, European companies must remain free to disengage from operations in countries affected by sanctions based on their risk assessment.

如果欧洲运营商面临无法摆脱法律冲突的局面,并影响到它们在不同国家的业务,欧洲公司必须根据其风险评估,保有从受制裁影响国家的业务中抽身的自由。

Bring into full operation the special purpose vehicle (SPV) “Instrument in Support of Trade Exchanges” (INSTEX) to facilitate new operations in sectors that are not subject to extraterritorial sanctions (e.g. humanitarian trade) and to build trust in the system to ensure that it can be used not only for trade with Iran but also for other countries, and gradually extend the scope of products that can be processed as part of “legitimate trade”. The aim should be also to extend the membership to build political resilience and to ensure a very tight exchange of information on activities with and between EU member states. To this end, the European Commission should be closely involved in the operation but BusinessEurope would discourage a direct integration of this mechanism in EU governance structures due to political risks.

促成特殊目的工具“INSTEX”充分运作,以促进在不受域外制裁的行业(例如人道主义贸易)开展新的业务,并建立对该工具的信任度,确保使之不仅可用于与伊朗的贸易,也可以用于其他国家的贸易,并逐步扩大可作为“合法贸易”予以处理的产品的范围。除外,还应扩大成员国的范围,以建立政治弹性,并确保就与欧盟成员国或者欧盟成员国之间的活动进行非常紧密的信息交流。为此,欧盟委员会应予以密切参与。由于政治风险,兴业欧洲将不鼓励将这一机制直接纳入欧盟治理结构。

In order to build trust in this new tool among companies, increased exchange with stakeholders would be beneficial to clarify its functioning. Specifically, increased transparency on transactions carried out by INSTEX as well as the legal obligations for companies regarding compliance and due diligence would be welcomed. Untransparent processes feed distrust among economic operators, increase compliance risks and disincentivise the use of INSTEX in the longer run.

为了在公司之间建立对这一新工具的信任,增加与利益攸关方的交流将有助于澄清其运作情况。具体而言,倡导增强INSTEX所进行的交易的透明度以及增加公司合规以及恪尽职守的法律义务。流程不透明将助长经济运营商之间的不信任,增加合规风险,长期而言,并打消使用INSTEX的积极性。

Even with INSTEX in place, many operators could encounter issues when finalising legitimate operations as certain service providers and systems remain exposed to the risk of unilateral sanctions. For such cases, it should be explored how legal clarifications and mechanisms could contribute to enhance the protection of companies.

即使有了INSTEX,许多运营商在最终完成合法业务时也可能遇到问题,因为某些服务提供者和系统仍然面临遭受单方面制裁的风险。对于这种情况,应当探讨如何在法律上进行澄清以及什么机制可有助于加强对公司的保护。

In the specific case of the existing US sanctions on Iran, where banks are subject to US secondary sanctions, the EU should ensure that in order to allow “legitimate trade” to continue, Iranian counterparts that are necessary to complete the financial transactions remain connected to SWIFT.

在美国对伊朗现有制裁的具体案例中,银行受到美国的次级制裁,为了让“合法贸易”得以继续,欧盟应确保完成金融交易所必需的伊朗交易方仍连接于SWIFT系统。

Establish an effective channel for dialogue between the relevant EU and US institutions to coordinate the application of sanctions and to develop guidelines to help companies and financial services providers on both sides to comply with the applicable sanction regimes. This should be coordinated by a specific body as described below.

建立欧盟和美国相关机构之间的有效对话渠道,以协调制裁的实施,并制定指导方针,帮助双方公司和金融服务提供者遵守适用的制裁制度。这应该由下文所述的具体机构予以协调。

The Blocking Statute Regulation 阻断法规

In its current state, the Blocking Statute Regulation confronts many economic operators with a conflict of laws, in which US law often prevails. In many cases the Blocking Statute Regulation seems to fall short of achieving its objective. Any modifications with a view to strengthening the regulation must be done in a way that effectively tackles the risk of conflict of laws for companies and, by doing so, takes the diversity of sectors and their exposure to foreign legislation into full consideration.

在目前的状态下,阻断法规让许多经济运营商陷入法律冲突,而美国法律往往占上风。在许多情况下,阻断法规似乎没有达到目的。对于该法规进行强化性修订,都必须在公司可以有效应对法律冲突风险时方为可行,并且需要充分考虑多行业及其所面临的外国法律责任后果。

Further clarify the Regulation (EC) 2271/96 (“Blocking Statute Regulation”) to make the procedures clearer for entities and increase its effectiveness. To this end:

进一步释明《(EC)2271/96号条例》("阻断法规"),以使程序对于各实体来说更加明确,并增强其有效性。为此目的:

The regulation should clarify the role and responsibilities of both member state authorities and the European Commission in the process and ensure coherent information and implementation across the EU.

这一法规应该明确成员国当局和欧盟委员会在这一过程中的角色和责任,并确保全欧盟信息和实施的一致性。

A simultaneous modification of Articles 5 and 6 could increase the protective legal effect of the regulation. Careful consideration must be given to focusing the reform to defend European sovereignty and not to enter into an escalation or confrontation with the USA. Sectoral interests must be carefully balanced and the overall aim to reduce the risk of conflict of laws must be at the centre of any reform.

对第五条和第六条进行同时修订,凭以提高法律保护力度。必须慎重考虑着眼于维护欧洲主权的改革,避免与美国矛盾的升级和对抗。必须谨慎平衡行业利益,改革的总体目标必须是降低法律冲突风险,必须是改革的核心。

Article 5 (compliance prohibition):

第5条(禁止遵从外国法律)

The strategy to shield companies from receiving notifications does not guarantee that US courts will not convict companies even in absentia. Not being able to defend their interests in court can be particularly harmful for companies that own assets in the USA. In most cases, the currently discussed options of amicus curiae or the option to limit the defence to the motion to dismiss for lack of jurisdiction or constitutionality (example of the Helms Burton Act) are rather limited. In case of litigation, European companies should be able to protect their interests effectively and the Blocking Statute must provide a supportive framework.

让公司不接收外国(司法或者执法)文书,这个策略并不能保证美国法院不会在缺席的情况下定罪。无法在法庭上扞卫自己的利益,可能会对在美国拥有资产的公司造成特别严重的伤害。在大多数情况下,目前讨论的法庭之友的选择,或将辩护限制在管辖权或合宪性异议的选择(例如《赫尔姆斯伯顿法》),仍有其局限性。在发生诉讼的情况下,欧洲公司应该能够有效地保护它们的利益,而《阻断法规》必须提供框架性支持。

Clarify what obligations are already effective regarding the opening of legal procedures in support of the implementation of sanctions imposed by foreign jurisdictions. For instance, the obligations of European legal service providers in cases involving an extraterritorial legislation listed in the annex to the Blocking Statute Regulation are unclear. Such clarification should be included in the Commission’s ‘frequently asked questions’ explanatory guidance and any existing obligation should be clearly communicated to the relevant legal service providers. Any obligation must in no way affect EU companies’ rights to receive legal advice regarding their case.

明确在开启法律渠道以支撑执行外国制裁方面有哪些已生效的义务。比如,欧洲法律服务提供者在涉及《阻断法规》附件所列域外立法的案件中的义务并不明确。这些澄清应该包含在委员会的“常见问题”解释性指引中,并且任何现有的义务都应该清楚地传达给相关的法律服务提供者。任何义务都不能以任何方式影响欧盟公司就其案件获得法律建议的权利。

With regards to the possibility under Article 5 to receive authorisation for non-compliance under certain criteria, BusinessEurope would like to point out that such authorisations to specific sectors are not isolated but also have a significant impact on other sectors as they are relying on their services. Careful consideration between authorisations under Article 5 and protection/recovery of damages under Article 6 is key to ensure appropriate legal balance to protect the interests of the various affected sectors under EU legislation.

关于第5条规定的因某些条件下不合规行为可获得授权的可能性,《兴业欧洲》希望指出,对特定行业的此类授权并非孤立的,同样也会对依赖其服务的其他行业产生重大影响。仔细考虑第5条下的授权和第6条下的保护/索回损失是确保适当法律平衡的关键,以保护欧盟立法下受影响的各个行业的利益。

Procedures for the request of authorisations for non-compliance should be simplified. The administrative burden for the argumentation of necessity of non-compliance as well as the required provision of documents should be kept to a minimum.

应简化不遵从《阻断法规》授权之申请程序。论证该不遵从的必要性以及提供所需文件的行政负担,应保持在最低限度。

It would be helpful to gather and share general information on how member states enforce prohibitions and how incompliance is sanctioned while respecting confidentiality and commercial concerns.

有必要收集和分享成员国如何执行禁令以及在尊重保密和商业考虑的情况下如何制裁违规行为的一般性信息。

It would be helpful that the Commission clarifies the status of European affiliates of US companies and service providers to establish if they are subject to the Blocking Statute Regulation like companies established directly within the EU (including the possible need to trigger Article 5 of the regulation to remain compliant with foreign legislations on a case-by-case basis if necessary).

欧盟委员会应该澄清美国公司和服务提供者的欧洲分支机构的地位,以确定它们是否像直接在欧盟境内设立的公司一样受到《阻断法规》的约束(包括可能需要触发该法规第5条,以确保在必要时根据具体情况遵守外国立法)。

Article 6 (recovery of damages):

第六条 追索损害

The recovery of damages under the Blocking Statute Regulation is limited as in many cases, the plaintiffs are individuals who hold limited or no assets that could be seized under a judicial proceeding in the EU, or companies face unclarities regarding the judicial proceeding that is a requirement for such claims. Hence, the protection of and support to companies is still largely ineffective under Article 6. In order to explore the possibility to recover losses the Commission should further clarify the procedures necessary to claim compensation in the Q&As, precising possible alternatives that would allow companies to get compensated in the event the other party does not hold assets in the EU.

根据《阻断法规》的规定,在很多情况下,追索损害有其局限,原告(原文如此,应为被告)是持有有限的根据欧盟的司法程序可予以扣押得资产或没有资产的个人;或者公司面临关于提出该等权利主张所要求的司法程序的不确定性。因此,第6条项下对公司的保护和支持在很大程度上仍然效果不佳。为了探讨追索损害的可能性,委员会应在问答中进一步澄清追索损害所需的程序,提出可能的备选办法,允许公司在另一方不持有欧盟资产的情况下获得赔偿。

Step up measures to defend European sovereignty in the area of sanctions

加强在制裁领域捍卫欧洲主权的措施

To ensure a coherent approach and implementation and adequate enforcement of sanction policy across EU member states, setting up an intergovernmental platform of EU member states, coordinated by the European Commission with a very clearly targeted and limited scope, should be considered.

为确保在欧盟成员国之间采取协调一致的方法实施和充分执行制裁政策,应考虑建立一个由欧盟委员会从中协调、目标明确、范围有限的欧盟成员国政府间平台。

This structure should:

这一结构应:

constitute a European interlocutor for third countries in order to obtain clarifications in terms of compliance with sanctions.

成为与第三国间的欧洲方面的对话者,以便澄清遵守制裁的情况。

act as a relay for European companies and provide support, both of technical and political nature. This is particularly important given the (deliberate) uncertainty around the operation of sanctions and the resulting tendency of financial services providers and companies in general to be extremely cautious to prevent any potential liability if left in doubt, including proceeding to a considerable reduction of their exposure to affected markets. This, together with the political imbalance between foreign judicial systems and individual affected companies, exacerbates the effect of third-party sanctions beyond their legal basis.

成为欧洲公司的接力者,并提供技术和政治支持。这一点尤其重要,因为制裁的(故意的)不确定性,金融服务提供者和公司因而都非常谨慎,以防止任何潜在的责任,包括着手大幅减少其在受影响市场的风险敞口。这一点,再加上外国司法系统和个别受影响公司之间的政治不对等,加剧了第三方制裁的影响,超出了其法律基础。

coordinate and support member states with a view to ensuring a coherent and unified approach to handling third-country sanctions (incl. the Blocking Statute Regulation) and implementing EU sanctions.

协调和支持成员国,以确保在处理第三国制裁(包括《阻断法规》)和执行欧盟制裁时采取一致和统一的方针。

the exact setup of this body under coordination of the European Commission with close ties to member states should be explored and tested with member states.

在欧盟委员会的协调下,应该与成员国共同探讨和测试与成员国有密切联系的这一(平台)机构安排。

The toolbox to deter claims against EU companies based on specific third-country sanctions falling under the Blocking Statute Regulation should be enforced and allow for countermeasures to compensate unilateral decisions after a clear procedure. While keeping in mind restrictions due to different levels of competence, coordinated measures like visa restriction or asset freezes should be tested with member states.

阻止针对欧盟公司的索赔,应根据具体的《阻断法规》项下的第三国制裁规定执行,并在程序明确之后允许采取反措施对单边决定进行索赔。在牢记由于能力不同的局限的同时,应与成员国一起测试诸如签证限制或资产冻结等协调措施。

This intergovernmental platform should monitor cases in which third-country entities benefit directly or indirectly from absence of level playing field on other markets created by their domestic extraterritorial sanctions affecting European companies.

这一政府间平台应该监测第三国实体直接或间接受益于因影响欧洲公司的国内域外制裁措施而在其他市场上缺乏公平竞争环境的情况。

Reinforce the international role of the euro in international payments

加强欧元在国际支付中的国际作用

As the Commission communication noted, the most important factor driving the external use of the euro is the confidence of market participants in the euro itself. To continue to build confidence and generally strengthen the resilience of Europe’s economy in the post-COVID-19 recovery, it is essential that the EU continues to deepen the EMU, particularly through completion of the Banking Union and the Capital Market Union and putting in place a stabilisation function to address asymmetric economic shocks in member states. The EU should also ensure the free flow of capital and encourage an efficient innovative payment system to support cross-border trade and the development of the (digital) Single Market. This will help to translate the economic power of the Single Market also into economic resilience and leverage.

正如委员会通讯所指出的那样,推动外部使用欧元的最重要因素是市场参与者对欧元本身的信心。为了在后COVID-19之后的复苏中继续建立信心并普遍加强欧洲经济的恢复力,欧盟有必要继续深化欧洲货币联盟,特别是通过完成银行联盟和资本市场联盟,并建立稳定职能以解决对于成员国的不对称经济冲击。欧盟还应确保资本的自由流动,并鼓励高效的创新性支付体系以支持跨境贸易和(数字)单一市场的发展。这将有助于将单一市场的经济力量转化为经济恢复力和杠杆效能。

Identify market barriers and incentivise the greater external use of the euro, for instance by

找出市场障碍并鼓励更多地对外使用欧元,例如通过:

Examining the scope to incentivise the use of the euro for financial institutions responding to market logic;

审查对符合市场逻辑的金融机构使用欧元的激励范围;

Exploring options on how to decrease the costs of using the euro compared to the US dollar in certain transactions;

探讨在某些交易中如何降低使用欧元(相对于美元而言)的成本的备选办法;

Exploring general options on how to cover exchange rate risks, e.g. by the possibility of non-selective public guarantees;

探索覆盖汇率风险的总体选择,如非选择性公共担保的可能性;

Working on euro benchmarking and referencing on some markets like oil (esp. downstream), gas, hydrogen, raw materials, metal or food commodities;

致力于欧元基准化与在石油(尤其是下游),天然气,氢气,原材料,金属或食品等一些市场上的参照系;

Involving central banks;

中央银行的参与;

Rethinking the role of digital currencies and take the lead on digital payment system (to not have shady cryptocurrency subsystems and dark commerce).

重新考虑数字货币的作用,并在数字支付系统上起主导作用(以免拥有不安全的加密货币子系统和暗交易)。

BACKGROUND 背景

Annex I: A stronger international role of the euro

附件一:增强欧元的国际角色

The biggest challenge in the area of extraterritoriality of sanctions is the dominant role of the US dollar in the international financial system and its importance as the world’s main reserve currency. Transactions across the world are conducted in dollars and, despite not being otherwise connected to the USA, they often run through US banks or clearing organisations which exposes such transactions to US sanctions law. A further complication is the impact on the SWIFT, the global financial transaction communication network which was established under Belgian law. For instance, the USA have put pressure on SWIFT to disconnect Iranian banks from its systems, basically cutting them off from the global system and making it technically extremely difficult for them to engage in financial transactions even with those financial institutions that would be willing to do so.

在制裁域外管辖领域的最大的挑战,是美元在国际金融体系中的主导作用及其作为世界主要储备货币的重要性。世界各地的交易都是以美元进行的,尽管与美国没有其他联系,但它们经常通过美国银行或清算组织进行,这些银行或清算组织将此类交易暴露在美国制裁法之下。另一个复杂因素是对SWIFT的影响,SWIFT是根据比利时法律建立的全球金融交易通信网络。例如,美国向SWIFT施压,要求其切断伊朗银行与系统的联系,从根本上切断了伊朗银行与全球系统的联系,使它们在技术上极难从事金融交易,即便与那些愿意这样做的金融机构交易,也是如此。

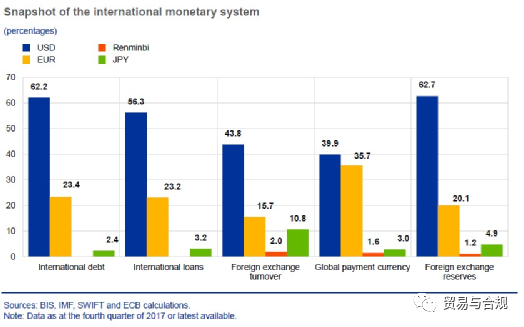

This has led to a reflection in the European Union on how to further the euro’s global role to also better reflect the euro area’s economic and financial weight.[0] The euro is the second most widely used currency accounting for 36% of global payments (the US dollar for 40%) in 2017. However, the share of the euro as international reserve currency is at 20% while the US dollar’s share is 63%.

这导致欧盟对如何进一步发挥欧元在全球范围内的作用进行反思,以更好地反映欧元区的经济和金融实力。欧元是第二大使用货币,占2017年全球支付的36%(美元占40%)。但是,欧元作为国际储备货币的份额为20%,而美元的份额为63% 。

Graph from ECB interim report “The international role of the euro”(2018)

欧洲央行临时报告《欧元的国际作用》(2018)中的图表

While there might be financial arguments speaking in favour of a wider global use of the euro (e.g. removal of exchange risks esp. for SMEs, lower interest rates asked by investors, more reliable access to finance, etc.), the most striking argument still seems to be the autonomy argument in the global financial system. However, the dollar still has significant advantages as a currency for international transactions and it will require meaningful political action and time to increase the attractiveness of the euro as an alternative for economic operators. Experts agree that the deepening of the Economic and Monetary Union as well as the completion of the Banking and Capital Market Unions are essential to strengthen the role of the euro globally.

尽管可能有一些有关金融方面的论据主张支持在全球范围内广泛使用欧元(例如消除汇率风险,尤其是中小型企业的汇率风险,按照投资者要求降低利率,获得更可靠的融资渠道等),但最引人注目的主张仍然似乎是在全球金融体系中的自主性。但是,美元作为国际交易货币仍具有显着优势,需要采取有意义的政治行动以及需要时间提升欧元作为经济运营商的替代货币的吸引力。专家们一致认为,经济和货币同盟的深化以及银行业和资本市场联盟的建立,对于加强欧元在全球范围内的作用至关重要。

A more political question would be whether the EU takes a decision to pursue an active agenda to increase the share of euro-denominated transactions in certain sectors in which the traditional role of the US dollar is still prevalent. The reasons for this differ between sectors. For instance, the oil industry is mainly trading in US dollars because the benchmarking is done in US dollars. In other sectors, esp. those with transactions of large sums, companies in the supply chain want to avoid running an exchange rate risk. In other sectors, business has an interest in maintaining flexibility regarding the choice of transaction currency for stronger bargaining positions.

一个更具政治性的问题是,欧盟是否决定推行一项积极的议程,以提高某些美元仍占主导地位的行业中以欧元计价的交易的份额。造成这种情况的原因各不相同。例如,石油行业主要以美元进行交易,因为基准是以美元进行的。在其他行业,特别是那些有大额交易的行业,供应链中的公司希望避免汇率风险。在其他行业,企业有兴趣在选择交易货币方面保持灵活性,以获得更有利的谈判地位。

Annex II: Iran and Cuba

附件二:伊朗和古巴

In the case of Iran, upon its withdrawal from the Joint Comprehensive Plan of Action (JCPOA) the USA not only introduced new sanctions but also reintroduced “secondary sanctions” that had previously been lifted under the agreement. These are targeting the operations of non-US actors in the United States in the event they engage in transactions with the sanctioned country in listed areas. The extraterritorial reach of US sanctions law is particularly noticeable for EU companies and financial institutions because US law prohibits them from doing business that they are allowed to do under EU law. Despite measures taken by the EU to shield companies with the Blocking Statute Regulation, this led to a situation where companies operating both in Iran and the USA were practically deterred from continuing their legitimate business and upholding their contractual obligations in Iran to ensure their US market operations would not be hit by sanctions.

在伊朗问题上,美国退出《全面联合行动计划》(JCPOA)后,不但实施了新的制裁,还重新实施了此前根据该协议解除的“次级制裁”。这些制裁的目标是非美国行为体在美国境内与受制裁国家进行在制裁清单所列的交易。美国制裁法的域外影响对欧盟公司和金融机构尤其引人注目,因为美国法律禁止它们从事欧盟法律所允许从事的业务。尽管欧盟采取了措施,以《阻断法规》卵翼欧洲公司,但这导致了在伊朗和美国均经营的公司实际上无法继续合法业务以及履行其在伊朗的合同义务,以防在美国的市场经营遭受重创。

In the case of Cuba, the Helms-Burton Act allows for claims to be launched against EU companies doing business in and with Cuba on the basis of their trafficking in property confiscated by the Cuban government on or after 1 January 1959. European companies have invested in many sectors, including manufacturing, infrastructure and services making them vulnerable to claims. Furthermore, the US embargo against Cuba also means that US companies cannot do business involving services or products originating in Cuba. In case of very stringent application of the regime by the US Administration, European companies face problems with US service providers like banks, credit card systems, web hosting services, etc.

就古巴而言,《赫尔姆斯-伯顿法》允许对在古巴境内以及与古巴有业务往来的欧盟公司提出索赔,理由是这些公司在1959年1月1日或之后贩运被古巴政府没收的财产。欧洲企业在许多领域进行了投资,包括制造业、基础设施和服务业,这使它们易于被追索。此外,美国对古巴的禁运还意味着美国公司不能从事涉及原产于古巴的服务或产品的业务。在美国政府非常严格地实施这一制度的情况下,欧洲公司均遇到美国服务提供商(如银行、信用卡系统、网络托管服务等)问题。

Annex III: Measures already taken

附件三:已经采取的措施

The Blocking Statute Regulation 阻断法规

Currently the EU’s only direct tool at hand is the Regulation (EC) 2271/96 (“Blocking Statute Regulation”) that is aimed at blocking the application of third-country secondary sanctions to EU actors, e.g. businesses and financial institutions (also EU subsidiaries and affiliates of US companies and US citizens resident in the EU). It prohibits EU actors under the risk of fines to

目前,欧盟手上唯一的直接工具是(EC)2271/96(“阻断法规”),旨在阻断第三国对欧盟主体,如企业和金融机构(以及美国公司的欧盟子公司和附属公司以及居住在欧盟的美国公民)实施次级制裁的法规(的域外效力)。该法规禁止欧盟主体在面临罚款风险的情况下,从事以下行为:

Comply with any requirement or prohibition under listed US sanctions against Cuba, Libya and Iran (“the blocked sanctions”);

遵从美国对古巴、利比亚和伊朗的制裁(“阻断制裁”)下的任何要求或禁止性规定;

Recognise or enforce any judgement or decision of a judicial or administrative authority outside the EU giving effect to “blocked sanctions”.

承认或强制执行欧盟以外的司法或行政当局作出的、“所阻断的制裁”得以发挥效力的任何判决或决定。

The Blocking Statute Regulation also foresees that EU actors that experience damage from the application of the “blocked sanctions” could recover a compensation from the entity causing the damage (e.g. a bank that refuses a transaction due to US sanctions). However, procedures remain unclear and the potentially most important claim item, which are penalties from US authorities for the breach of sanctions, cannot be claimed back due to state immunity. The regulation also includes, under specific criteria and on decision by the European Commission, the possibility of an authorisation for EU actors to comply with the US sanctions if not doing so would seriously damage EU operators' interests, or those of the EU.

《阻断法规》还预见到,因适用“所阻断的制裁”而遭受损害的欧盟主体可以向造成损害的实体(如因美国制裁而拒绝交易的银行)索偿。但是,程序仍待明确,且潜在的最重要索赔内容,即美国当局对违反制裁的处罚的损害,可能由于国家豁免权而无法奏效。该法规的规定还包括,根据具体标准并经欧盟委员会决定,欧盟主体如不遵守美国制裁将严重损害欧盟或欧盟运营商的利益的,则有可能获得关于遵从美国制裁的授权。

Reacting to the US withdrawal from the JCPOA the Commission adopted the Implementing Regulation (EU) 2018/1101 which extended the scope of the Blocking Statute Regulation to add the new US sanctions and established criteria for authorising EU actors to comply with US sanctions and established procedures for the submission of authorisation requests.

针对美国退出 JCPOA,欧盟通过了实施条例(EU(2018/1101),扩大了《阻断法规》的适用范围,增加了所阻断的新的美国制裁措施,确立了授权欧盟主体遵守美国制裁措施的标准,并明确了申请授权的程序。

In practice, the Blocking Statute Regulation has been very rarely used in its long history and the tool is considered largely ineffective due to a number of reasons. Most importantly, the damage being caused by a potential sanction on the US market or a cutoff from the US financial system is too high of a risk to take for a company, which is why despite the risk of fines under the regulation they choose to comply with US secondary sanctions. Furthermore, in the absence of a credible and workable indemnification mechanism, EU companies are caught between a rock and a hard place. Finally, additional guidance is needed for companies regarding the procedures for claims and authorisations under the regulation as well as for member states regarding the implementation of the regulation. Particularly, the role and leeway of member states in processing notifications and supporting companies should be clarified and harmonised. Given the possible diplomatic pressure resulting from third countries directly onto governments, it might be consequent to tighten member states’ obligations to offer all necessary support to affected European companies.

在实践中,《阻断法规》在其漫长的历史中很少得到运用,由于诸多原因,这一工具在很大程度上并没有奏效。最重要的是,对美国市场的制裁或切断美国金融体系所造成的损害,对一家公司来说,风险太大,难以承受,这就是为什么尽管根据该的法规面临被处罚的风险,它们还是选择遵守美国的次级制裁。此外,在缺乏可信可行的补偿机制的情况下,欧盟公司陷入了进退两难的境地。最后,需要为公司提供更多关于该法规项下的索赔和授权程序的指导,以及为成员国提供关于实施该法规的指导。特别是,成员国在处理(外国司法或者执法)通知和支持公司方面的作用和伸缩度等方面应该得到澄清和协调。考虑到第三国可能直接向各个政府施加外交压力,因此可能需要加强成员国向受影响的欧洲公司提供一切必要支持的义务。

Instrument in Support of Trade Exchanges (INSTEX) 贸易支持工具

In the case of Iran, upon its JCPOA withdrawal the USA not only introduced new sanctions but also reintroduced “secondary sanctions” that had previously been lifted under the agreement. These are targeting the operations of non-US actors in the United States in the event they engage in transactions with the sanctioned country in listed areas. The extraterritorial reach of US sanctions law is particularly noticeable for EU companies and financial institutions because US law prohibits them from doing business that they are allowed to do under EU law. Despite measures taken by the EU to shield companies with the Blocking Statute Regulation, this led to a situation where companies operating both in Iran and the USA were practically deterred from continuing their legitimate business and upholding their contractual obligations in Iran to ensure their US market operations would not be hit by sanctions.

在伊朗问题上,美国退出《全面联合行动计划》(JCPOA)后,不但实施了新的制裁,还重新实施了此前根据该协议解除的“次级制裁”。这些制裁的目标是非美国主体在美国境内或者与受制裁国家在制裁清单所列领域进行的交易。美国制裁法的域外影响对欧盟公司和金融机构处处可见,因为美国法律禁止它们从事欧盟法律允许它们从事的业务。尽管欧盟采取了措施以《阻断法规》保护欧盟公司,但这导致了在伊朗和美国均进行经营的公司实际上难以继续其合法业务以及履行其在伊朗的合同义务,以免它们在美国的市场经营遭受沉重打击。

Another action that was taken was to set up a special purpose vehicle (“Instrument in Support of Trade Exchanges”) that allows the accounting of economic exchanges with countries covered by American sanctions without using the dollar as transaction currency and without using access to the American financial system or SWIFT. The private entity was established in Paris in January 2019 by the UK, Germany and France and more countries have joined since. Its scope is currently limited to “legitimate trade” not under US sanctions (e.g. pharmaceuticals, medical devices, agri-food products). However, it has so far facilitated a limited number of transactions, related to humanitarian purposes in the context of the COVID-19 outbreak. In any case, the potential strengthening of US sanctions against Iran might include above-mentioned “legitimate trade” and hence make it difficult for INSTEX to act.

已经采取的另一项行动,就是建立一个特殊目的工具(“贸易支持工具”),允许在不使用美元作为交易货币、也不使用美国金融系统或SWIFT的情况下结算与美国制裁所涉国家的经济往来。该私人实体由英国、德国和法国于2019年1月在巴黎成立,此后有更多国家加入。其范围目前仅限于不受美国制裁的“合法贸易”(如药品、医疗器械、农产品)。然而,迄今为止,它为有限数量的交易提供了便利,这些交易与COVID-19疫情中的人道主义目的有关。无论如何,美国将来加强对伊朗制裁,可能包括上述“合法贸易”,因此将导致INSTEX难以发挥作用。

[0] The Commission has carried out a consultation on strengthening the role of the euro in the following five targeted sectors: foreign exchange markets; energy; non-energy, non-agricultural raw materials, metals and minerals; agricultural and food commodities; aircraft manufacturing, rail and maritime sector.

委员会就加强欧元在以下五个目标部门中的作用进行了磋商:外汇市场;能源; 非能源,非农业原料,金属和矿产;农业和粮食商品;飞机制造,铁路和海事部门。